What are tax credit scholarships?

The Illinois Tax Credit Scholarship Program, “Invest in Kids,” provides a 75 percent Illinois state income tax credit to individuals and corporations that contribute money to a non-profit Scholarship Granting Organization (SGO). The SGOs award scholarships to eligible students from low-income families. Donors will use money already owed to the state (taxes) and donate it to a needs-based scholarships instead, all while receiving a 75 percent state tax credit.

Through this program:

- An individual or corporation will receive a 75 percent credit on donations to an SGO. For example, if a person donates $100,000, they will receive a state tax credit of $75,000

- Individual donors can designate their donations to Archdiocese of Chicago Catholic Schools

- The credit can be rolled over for five years

- Donors are prohibited from receiving a federal tax deduction for these donations

Invest in Kids Today!

-

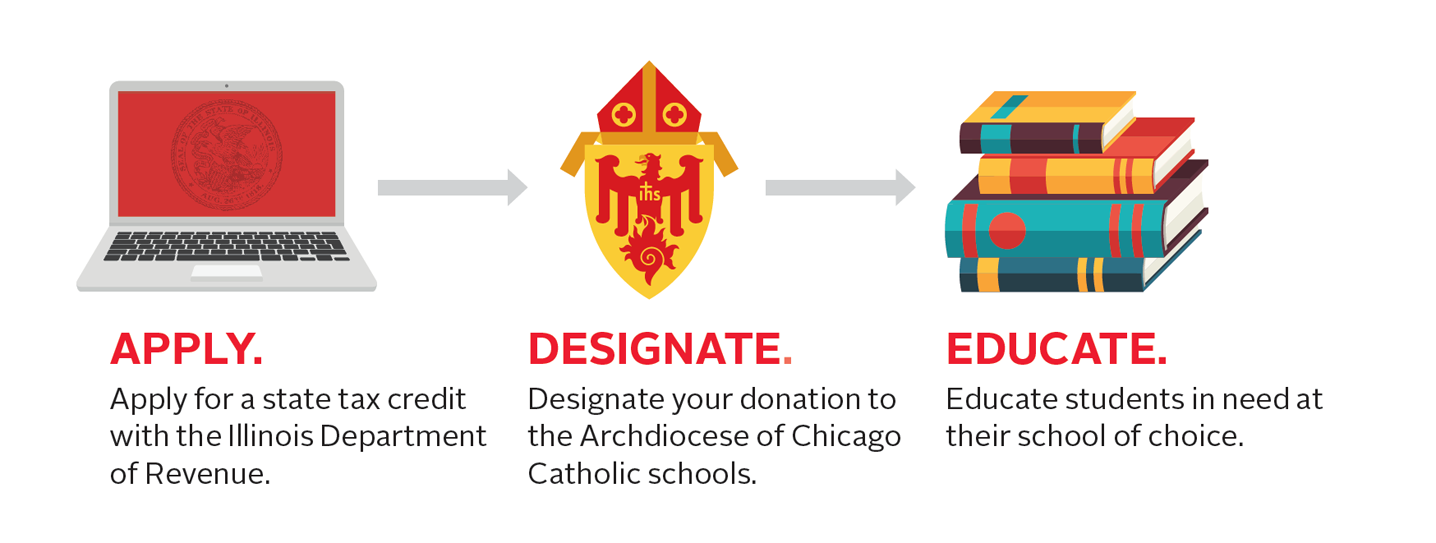

Individual and corporate donors can reserve tax credits through mytax.illinois.gov by following these steps:

- Create a MyTax Illinois account on mytax.illinois.gov. Anyone applying for a scholarship tax credit is required to have an account. If you do not have one, the first step is requesting a Letter ID from the Illinois Department of Revenue.

- CLICK HERE for step-by-step instructions on how to request a Letter ID.

- CLICK HERE for step-by-step instructions on how to activate your my tax account.

- Apply for a tax credit on mytax.illinois.gov. Donors will need to provide the following information:

- Region to which he/she plans to donate

- Name of SGO to which he/she plans to donate (the Archdiocese is partnering with Empower Illinois)

- Amount he/she plans to donate

- CLICK HERE for step-by-step instructions on how to apply for the credit

- Donate to the SGO within 60 days of receiving your application approval and the Contribution Authorization Certificate.

- Designate the donation to Archdiocese of Chicago Catholic Schools.

- Contribution Authorization Certificate

- Create a MyTax Illinois account on mytax.illinois.gov. Anyone applying for a scholarship tax credit is required to have an account. If you do not have one, the first step is requesting a Letter ID from the Illinois Department of Revenue.

For a letter from Fr. Hyland, please click here.